Goods & Service Tax

- GST Registration Services

- GST Returns Fillings & Tax Payments

- GST Advise on Input Tax Credit

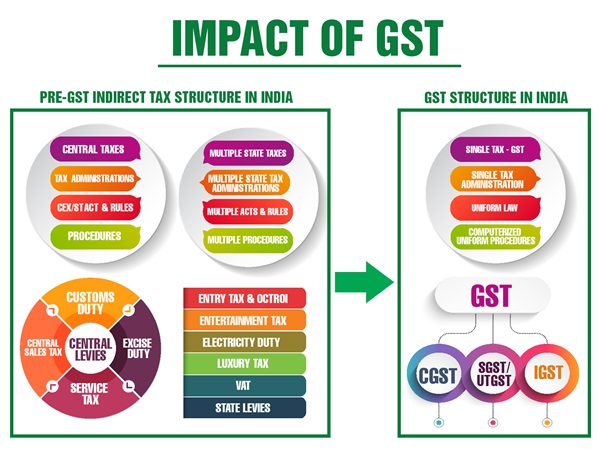

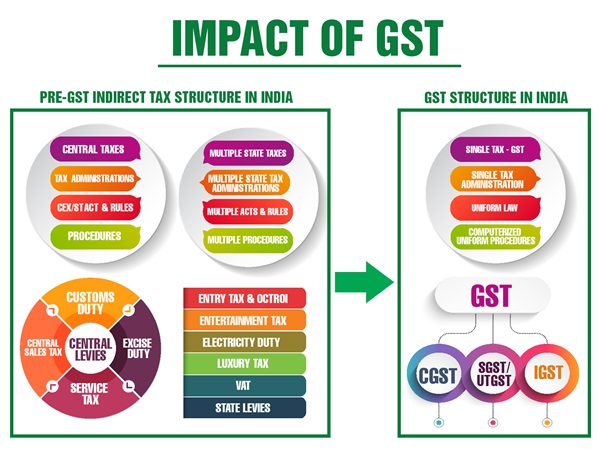

- GST

Tax

Planning

GST Registration Services

- Registration under GST means obtaining a unique identity no. from the concerned authorities.

- So, instead of the name of the tax payer the identity no. of tax payer is his / her identification for tax purpose.

- As per Section 22 of the CGST / SGST Act 2017 , every supplier which makes a taxable supply i.e. supply of goods or services which are leviable to tax underGST law , and his aggregate turn over in a financial year exceeds the threshold limit of 40 lakh rupees shall be liable to register himself .

- In case of elven special category states this threshold limit for registration liability is 10 lakh rupees.

- As per Section 23 of the Act, the following persons shall not be liable for registration: Any person engaged in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under this act or under the Integrated Goods and Services Tax Act. An agriculturist, to the extent of supply of procedure out of cultivation of land.

- The following categories of persons shall be required to be registered under this act:

- Persons making any inter-state taxable supply;

- Casual taxable persons making taxable supply;

- Persons who are required to pay tax under reverse charge;

- Non- resident taxable persons making taxable supply;

- Persons who are required to deduct tax under whether or not separately registered under this act;

- Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

- Input Service Distributor , whether or not separately registered under this act;

- Every electronic commerce operator;

1. PERSON LIABLE FOR REGISTRATION

2. PERSON NOT LIABLE FOR REGISTRATION :

3. COMPULSORY REGISTRATION IN CERTAIN CASES

4. INDIVIDUAL / SOLE PROPRIETORSHIP :

5. PARTNERSHIP FIRM:

Time Period :

7. PRIVATE LIMITED COMPANY :

Time period

8. LIMITED LIABILITY PARTNERSHIP (LLP)

9. COMPOSITION SCHEME :

10. CASUAL TAXABLE PERSON :

GST Returns Fillings &Tax; Payments

GST Act requires the registered person to file return as per the prescribed format and time as specified .

PURPOSE OF FILING RETURN

GST ADVICE ON INPUT TAX CREDIT

GST is destination based tax and Input Tax Credit is the core provision of GST.

GST TAX PLANNING

GST tax planning is the systematic process of reducing the tax liability by using various provision sunder the law . The main purpose behind tax planning is not only reduction of tax liability but also to the minimization of litigation . Tax planning means to reduce the tax liability by taking maximum benefits of the provisions under the law.